Employee Stock Ownership Plans (ESOPs) have become a great tool for companies to attract, retain, and motivate top talent. By offering employees a stake in the company’s success, ESOPs align employee interests with those of the shareholders, fostering a culture of ownership and long-term commitment.

However, despite all the benefits, ESOPs are complex in nature and require careful examination for accounting and reporting. Errors in reporting can lead to significant misstatements in a company’s financials, affecting its net worth, profitability, and even investor confidence.

Let’s explore two common errors in ESOP reporting that finance professionals and company founders should be aware of. By understanding these, you can ensure accurate financial reporting and avoid potential financial discrepancies.

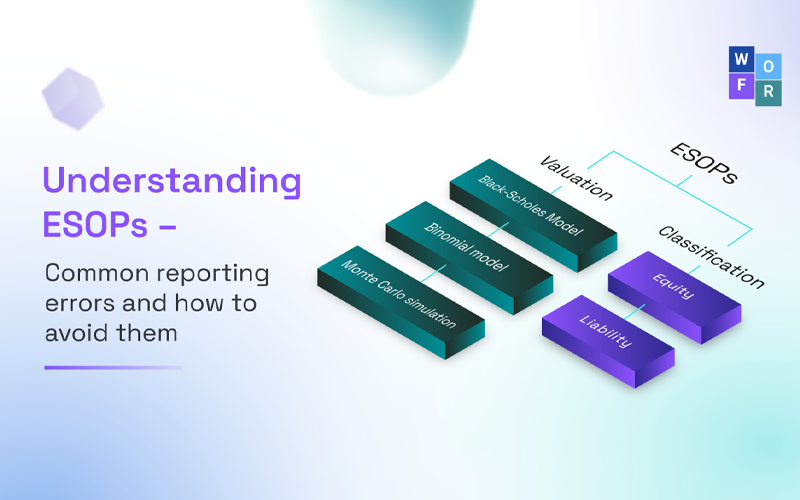

Issue 1: Classification

How are ESOPs generally structured?

ESOPs are generally structured to provide employees with company shares after they have completed a specified vesting period or met certain performance conditions, such as achieving a target share price or revenue. The most common accounting treatment for ESOPs would be to recognize an expense in the company’s financials and credit equity. This method is net worth neutral, meaning it doesn’t affect the company’s overall net worth.

However, complications arise when the ESOP includes a cash payout option, such as a share buyback. In these cases, instead of crediting equity, the company may need to record a liability in its balance sheet. This shift from equity to liability would reduce the company’s net worth and impact profitability.

The impact of cash payout on net worth

As the company’s valuation increases, so does the associated liability, as the company will need to buy back shares at a higher price. This growing liability reduces net worth and negatively affects future profitability.

For example, consider a tech startup with an ESOP that includes a cash payout option. If the startup’s valuation doubles due to rapid growth, the liability for the ESOP also doubles. This can lead to a substantial reduction in net worth, which might come as a surprise to founders and investors who were expecting higher profitability based on the company’s growth trajectory.

How to avoid this error

To avoid this, it’s crucial to thoroughly review the ESOP agreement and identify whether it includes any cash payout provisions. If such provisions exist, the ESOP should be classified as a liability rather than equity. Accurate classification ensures that financial statements reflect the true financial position of the company and prevent unexpected reductions in net worth as the company grows.

Issue 2: Valuation

Challenges in valuation

Many ESOPs are tied to performance conditions, such as achieving a share price, revenue target, or company valuation. These conditions are often contingent on future events that may not unfold as expected, making the valuation of these options particularly challenging.

A common error in valuing performance-linked ESOPs is using incorrect valuation models. Companies sometimes apply the Black-Scholes model, a standard tool for option valuation that assumes a constant risk-free rate and constant volatility, to performance-linked ESOPs. However, this model is unsuitable for such ESOPs as it does not account for the multiple potential future outcomes that performance conditions can have.

The right valuation method

For ESOPs linked to performance conditions, valuation models like the Binomial model or Monte Carlo simulation are generally more appropriate. These models are capable of handling the complexities of performance conditions by simulating different potential outcomes and assigning probabilities to each.

For instance, a Monte Carlo simulation might be used to have a range of future share price scenarios and determine the probability of meeting a performance condition, such as achieving a target share price. This approach results in a more accurate valuation of the ESOP, ensuring that the expense recognized in the financial statements reflects the true cost to the company.

Accurate Valuations

It’s important to ensure that all relevant inputs, such as volatility and risk-free rate, are accurately estimated and incorporated into the valuation model. By doing so, companies can avoid under or over-reporting ESOP expenses. This ensures that the financial statements accurately reflect the true cost of these plans.

Conclusion

ESOPs are powerful tools, but they come with complex reporting requirements that must be managed carefully. Misreporting cash payouts and using inappropriate valuation are two common errors that can significantly impact a company’s financial statements.

For finance professionals and company founders, understanding the nuances of ESOP accounting is essential. By carefully structuring ESOPs, accurately classifying liabilities, and selecting the right valuation methods, you can ensure that your company’s financial reports are both accurate and transparent. This helps build trust with investors, shareholders, and employees.

Whether you’re managing the books or considering implementing an ESOP, getting the reporting right from the start will protect your company’s financial integrity and maintain its reputation in the market.